Costing for setting up a spinning plant/factory

A series of factors pertaining to setting up a spinning plant is explained.

The Plant & Machinery required for the Spinning Mill process for manufacturing yarn of different counts are blow room machinery, metal detection system, spark diversion system, carding machines, card accessories, draw frame (Finisher & Breaker), speed frame, combers, ring frame, electrical infrastructure, yarn testing 4 instruments, humidification and waste collection system and automatic cone winding machine etc.

Introduction

- Assuming a yearly interest rate of 6%, payable every year-end for a period of 10 years.

- Capital payable at the beginning of every year, starting from the fourth year for a period of 7 years.

- Average sale price established previously in Table III.

- Doffing percentage subjected to 10% for the card, 20% for combed and 2% for chemical fiber.

- Loan amount of USD 800 x 150,000 Spindles = USD 120,000,000.

20’s Spinning

Table I

| Year | Total sale minus material price (USD) | Minus capital and interest rate of 6% (USD) | Surplus (USD) |

|---|---|---|---|

| 1st Year | – | 7,200,000 | 7,200,000 |

| 2nd Year | 23,788,704 | 7,200,000 | 16,588,704 |

| 3rd Year | 47,577,396 | 7,200,000 | 40,377,396 |

| 4th Year | 47,577,396 | 23,314,285 | 24,263,111 |

| 5th Year | 47,577,396 | 22,285,714 | 25,291,682 |

| 6th Year | 47,577,396 | 21,257,142 | 26,320,254 |

| 7th Year | 47,577,396 | 20,228,571 | 27,348,825 |

| 8th Year | 47,577,396 | 19,200,000 | 28,337,396 |

| 9th Year | 47,577,396 | 18,171,428 | 29,405,968 |

| 10th Year | 47,577,396 | 17,142,857 | 30,434,539 |

| Total | 404,407,872 | 163,199,997 | 241,167,875 |

| 11th Year thereafter | 47,577,396 | 0 | 47,577,396 |

- Production is halved in the second year.

- Yearly interest rate based on capital x 6%, not using day count convention.

- Because there is no revenue in the first year, the loan payable of USD 7,200,000 must be prepared in advance.

- If spinning 20’s, revenue should deduct a tax of 15% and yearly expenditure growth of 3%. The yearly expenditure would be USD 1,194,750 x 12 = USD 14,337,000.

Table II

| Year | Surplus (USD) | Minus yearly expenses (USD) | Minus Tax (USD) | Profit |

|---|---|---|---|---|

| 1st Year | 7,200,000 | 7,168,500 | – | 14,368,500 |

| 2nd Year | 16,588,704 | 10,752,750 | 2,488,306 | 3,347,648 |

| 3rd Year | 40,377,396 | 14,767,110 | 6,056,609 | 19,553,677 |

| 4th Year | 24,263,111 | 15,210,123 | 3,639,749 | 5,413,239 |

| 5th Year | 25,291,682 | 15,666,427 | 3,793,859 | 5,831,396 |

| 6th Year | 26,320,254 | 16,136,420 | 3,948,149 | 6,235,685 |

| 7th Year | 27,348,825 | 16,620,513 | 4,162,409 | 6,625,903 |

| 8th Year | 28,337,396 | 17,119,128 | 4,250,759 | 6,967,509 |

| 9th Year | 29,405,968 | 17,632,702 | 4,417,019 | 7,356,247 |

| 10th Year | 30,434,539 | 18,161,683 | 4,565,309 | 7,707,547 |

| Total | 241,167,875 | 149,235,356 | 37,262,168 | 54,670,351 |

| 11th Year thereafter | 47,577,396 | 18,706,533 | 7,136,609 | 21,734,254 |

- Need to prepare 50% of monthly outlay in the first year to buy machines and construct the mill.

- Need to prepare around 75% of monthly outlay in the second year while the production is halved due to the installation of machines.

- From the third year, yearly outlay will increase by 3% every year.

- Necessary to ingeniously arrange the first year expense of USD 7,168,500 and the 6% interest rate of USD 7,200,000 = USD 14,369,500.

- A tax of 15% is based on 15% of surplus or can be calculated by subtracting all raw material, machine parts, and miscellaneous expenses from the surplus and then getting 15%.

- The local government policies can also determine that interest rate is less than 15% or even tax-free for a few years and this should be recalculated according to local accounting practices.

The influence of spin count and category on profit

- If A produces 20’s carded, 20’s combed, 20’s RC for each 30,000 Spindles

- 20’s TC, 20’s CVC, 20’s PE and 20’s RY for each 15,000 Spindles

- If B produces 20’s combed, 20’s TC, 20’s CVC, 20’s RC for each 30,000 Spindles

- 40’s PE and 40’s RY for each15,000 Spindles

- If C produces 20’s combed, 30’s combed, 20’s TC, 30’s TC for each 30,000 Spindles

- 20’s RC and 30’s RC for each 15,000 Spindles

| Total sales minus material price (USD) | Minus capital cost and interest (USD) | Minus expenses for 10 years (USD) | Minus tax for 10 years (USD) | Profit (USD) | |

|---|---|---|---|---|---|

| A | 404,407,872 | 163,199,997 | 149,235,356 | 37,262,168 | 54,710,351 |

| B | 421,896,786 | 163,199,997 | 149,235,356 | 37,232,168 | 72,199,263 |

| C | 438,700,468 | 163,199,997 | 149,235,356 | 37,262,168 | 89,002,947 |

- After deducting the above selling price, raw material price, operational overhead, tax etc,

- A has an average yearly profit of USD 5,471,035

- B has an average yearly profit of USD 7,219,926

- C has an average yearly profit of USD 8,900,294

- If cash is used to buy material, no interest would be required but if letter of credit is used, need to calculate the interest rate and make payment within the stipulated period.

- If the total tax is not USD 37,262,168 as calculated in Table II, but only 50% to be USD 18,631,084, then the yearly interest rate would be USD 1,863,108 and the monthly rate would be USD 155,259.

- Then average yearly profit of A would be USD 5,471,035 + 1,863,108 = USD 7,334,134.

- Then average yearly profit of B would be USD 7,219,926 + 1,863,108 = USD 9,083,034.

- Then average yearly profit of C would be USD 8,900,294 + 1,863,108 = USD 10,763,402.

- If calculated further using a decade:

- A would have a profit of USD 73,341,340

- B would have a profit of USD 90,830,340

- C would have a profit of USD 107,634,020

- C would exceed A in a decade by USD 34,292,680, and every year by USD 3,429,268.

- C would exceed B in a decade by USD 16,803,680, and every year by USD 1,680,368.

- B would exceed A in a decade by USD 17,489,000, and every year by USD 1,748,900.

- If all factors such as production count, categories, yield, sale price, efficiency percentage and quality are appropriately managed, after deducting all expenses:

- There would be a net profit of USD 91,488,917 in 8.5 years, and USD 107,634,020 in a decade. The net profit of USD 91,488,917 is 76% of the loan sum of USD 120,000,000, and the net profit in a decade is 90% of the loan sum.

- Subject to a risk assessment of above USD 60,000,000 (in reality, a 150,000 Spindles factory can be acquired in a decade)

Assuming a loan amount of USD 800 x 150,000 Spindles = USD 120,000,000, and with an actual personal investment of 20%, only 80% needs to be loaned. In fact, in a decade, you will have already gained back the 20% personal investment of USD 24,000,000 and the interest rate 6% (around USD 8,640,000) for a total of USD 32,640,000.

| Year | Return on Investment of 20% | Plus Interest 6% | Total |

|---|---|---|---|

| 1st Year | – | 1,440,000 | 1,440,000 |

| 2nd Year | – | 1,440,000 | 1,440,000 |

| 3rd Year | – | 1,440,000 | 1,440,000 |

| 4th Year | USD 3,428,571 | 1,234,285 | 4,662,856 |

| 5th Year | 3,428,571 | 1,028,571 | 4,457,142 |

| 6th Year | 3,428,571 | 822,857 | 4,251,428 |

| 7th Year | 3,428,571 | 617,143 | 4,045,714 |

| 8th Year | 3,428,571 | 411,428 | 3,839,999 |

| 9th Year | 3,428,571 | 205,714 | 3,634,285 |

| 10th Year | 3,428,571 | 0 | 3,428,571 |

| Total | 24,000,000 | 8,639,998 | 32,639,998 |

Remarks:

After the personal investment and interest is collected back, it can be used for other purposes in the company and is another source of funds.

For the example of USD 120,000,000 loan amount used to open a 150,000SP factory, should especially take note of the below points.

- Lack of material: After the quality of material required is established and the source settled, the preventive measure should be arranged so as not to hinder production.

- Irregular count change: Often clients may demand a change in production count. If the average monthly count is changed, the production yield can decline and raw material pile up. Or if yield escalates too much, it will cause a lack of material. Count change should depend on sale price and revenue.

- Price change: Often happens while dealing with clients or desiring to clear surplus stock in the warehouse, or due to fraudulent behavior and corruption.

- Nepotism: Because they don’t have the necessary experience or training, yet often hold high positions, causing unbalanced mind-sets in those with actual ability, and influencing company growth.

- Exceeding loan: Reporting higher than actual prices for machines etc, and pocketing the difference or allowing the company to undertake the risk. This will result in a net loss after a few years, and the company will be unable to pay back the interest, much less the capital and can only resell the factory.

- Unable to redeem client revenue: Client payments should usually be received within 1-3 months. If unmindful of client trustworthiness can frequently be unable to retrieve revenue, especially without a letter of credit. Moreover, should routinely maintain contacts with various clients and industry sources, in order to obtain the latest trade information.

- Recycling: All doffing, waste, bale cloth, damaged machine parts etc, can be sold to supplement canteen supplies, medical and welfare services, and not thrown away as trash. Expenditures for employees, power source, machine components, packaging, transport, oil price, stationery, computer supplies etc should be controlled by specialized personnel and regularly checked by management.

- Delay capital and interest repayment: Because the loan period, repayment, and interest rates had all been mapped out and agreed upon with a loaning institution, they should be honored and settled timely. Even though the yearly capital repayment can be smaller with a longer loan period, the interest amount increases, therefore, it is wiser to finish the repayments quickly in order to develop other enterprises.

- Employee quality: Healthy personnel is essential, and with a probation period of 3 months, human resources can conduct background and personality checks. If not noticed, a production unit, especially with intricate light industry such as yarn spinning, can easily disrupt assembly and damage machines, even cause fires and ruin.

- Equipment maintenance: Equipment depends on electric power and cables, and need to be regularly maintained. Persistent power disruption can interfere with production and even cause fires.

- Unable to correctly amend yarn quality: When clients feedback on product flaws and employees or management lack the experience, they may experiment with various settings and in the process, waste material and time, and may not even be able to make the appropriate modifications. It is important to equip the right personnel with the right skill sets.

- If details such as employee hostels, canteens, transportation etc are not taken care of, staff will complain and be unable to concentrate, lowering the efficiency and production rate.

- Corrupt accounting department: Accounting clerks often act as the director’s personal teller, frequently carrying checks or cash, and if corrupt, are susceptible to moving company resources without returning them. It is imperative to implement a moral and scrupulous accounting system, with clear evidence of every debit and credit.

- Oblivious to stock placement in the warehouse: All kinds of material should be categorized and placed correctly, and not too high. There should be walkways wide enough for loaders, bales or product containers. The challenge is to increase security while also allowing for easy access, and reduce time wasted or excessive product handling.

- Negligent quality testing: The older generation of machine test results is not as sensitive or fast as the newer generation. Therefore international testing standards and machines, for example, USTER%, are preferred to examine half-finished and finished products, to inspire customer confidence and improve production speed. If testing is ignored, blemishes will be common and waste time to resolve, increasing the number of defects in the final product.

- Indeterminate classification of yarn counts and categories: Simple, clear methods should be used to label products. For example carded cotton can be marked as 20’s CA, combed as 20’s SCA (semi-combed grade A) or 20’s FCA (full combed grade A), and mixed yarn will have other modes of identification.

- Management should take note of unethical tactics such as making false reports to banks, distorting the material price, transferring revenue or letter of credit to an overseas account, while the evidence and money will slowly disappear. Care must be taken to set up strict audit controls to prevent such behavior.

- Misuse of loan: If the loan is divided up as below, there would be a cash reserve of 12.5% – USD 15,000,000, which can be used to make the first interest payment of 6%, and this reserve should not evaporate and affect the whole operation.

- Procuring machines take up about 55%, around USD 66,000,000.

- Acquiring property take up about 5%, around USD 6,000,000.

- All construction take up about 12.5%, around USD 15,000,000.

- Training, transportation, environment and road improvements, and stationery take up 2.5%, around USD 3,000,000.

- Purchase of raw material take up about 12.5%, around USD 15,000,000.

- Cash reserves of about 12.5%, around USD 15,000,000.

- The unit price of each bale of yarn should not be obscured and should be correctly calculated using the few methods below:

- Based on how many spindles are needed to produce each bale of yarn.

- Based on the unit price of each kilogram of raw material and the doffing percentage.

- Based on daily expenses plus the daily production expense of each machine.

Because the count and categories produced by a 150,000 Spindles factory are diverse, the per bale price should take into account the spindle speed, doffing percentage, efficiency and material price, along with the loan criteria and interest rate. If the mill is already loan-free, then the price can be self-determined or maintained, but A+ grade products should have a higher price in relation to the quality.

- Misguided perception of capital: Usually raw material is bought with a preference for lower prices, with the impression that this equals lower cost. What is not realized is that because of the differences in the percentage of short fibers, luster depth, micronair (fineness) and uniformity, the end product is often of poor quality, with recurrent broken ends. This leads to client complaints and difficulty in maintaining the sale price, much less increase it. A lot of companies mistakenly think to save cost by using the substandard quality material, because they know material cost is the next highest after machine cost. But in reality, they trapped themselves in a vicious cycle of perpetually buying inferior material to generate inferior cloth and forever unable to increase their sale price, until they have no choice in the end but to declare bankruptcy.

- If you already possess a spinning mill and has yet to see any profits, please investigate the reason, as summarized in the following:

- Is there any problem with the count and machine used?

- Is funding or interest a problem for the company?

- Are the various products of poor quality and thus incapable of raising sale prices?

- Are the employees mediocre, unable to increase efficiency or control product quality?

- Are expenses too high while production is too low, causing unsatisfactory resource circulation?

- Are the clients too far and thus consuming too much transportation cost?

If you encounter any of the above problems, the answers can be found in my composition.

- Various elements of spinning mill management, such as fund allotment, machine choice, production process, material testing, workforce expertise and balanced expense disbursement is a fundamental subject at spinning and weaving universities. And learning to identify the right clients is another aspect of successful management.

- Effective use of material can cut cost, and the following should be taken note of:

- The percentage of short fibers, because during production, they will end up as doffing waste.

- The accumulation of reclaimed cotton or half-finished products resulting in diminishing yield, and surge in broken ends, abnormal slivers, or persistent adjustments.

- Increased percentage of dross in material, reducing the useful amounts of material.

- By competently controlling the amount of stock used, 1-2kg of raw material and 0.5kg of chemical fiber can be conserved for every bale.

- For a 150,000 Spindles that produces 20’s, a tremendous quantity of resources can be spared, increasing profit.

Conclusion I

- The flowchart of various material and machines.

- Producing 100% carded, combed, polyester, rayon, mixed blend, TC, CVC, TC, TR.

Conclusion II

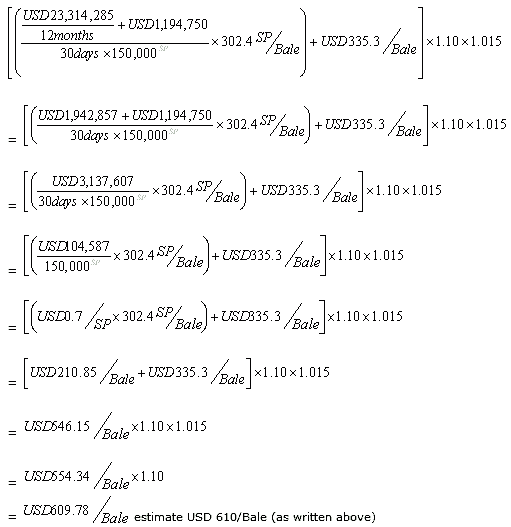

The loan amount, interest rate, yearly settlements, total spindles, average daily expenses, production count and load, efficiency, cost and quota of raw material, and profit all influence the final retail price, and consequently revenue. For example, for 20’s combed cotton, the unit price of each bale should be USD 610, proved by the below theorem.

Hypothesis:

- Loan of USD 120,000,000 with a 6% interest rate, for a total returnable of USD 163,200,000.

- Number of factories is 5, for a total of 150,000 Spindles.

- Average monthly expense of USD 1,194,750 (including tax).

- If 150,000 Spindles uses 20’s combed, 90% spindle produces 0.6kg

181.44 X 1/0.6 = 302.4 spindle produces 1 bale. - Combed cotton uses the material with 20% doffing

USD 1.54/kg x 181.44 x 1.2 = USD 335.3/Bale

USD 1.76/kg x 181.44 x 1.2 = USD 383.2/Bale - Each bale’s net profit is 10%, with a transportation cost of 1.5%

Calculates as (unified formula invented by yours truly):

When the price of material is USD 1.76/kg, the amount need is USD 383.2/Bale. Therefore, [USD 210.85/Bale + USD 383.2] x 1.10 x 1.015

= USD 594.05 x 1.10 x 1.015

= USD 602.96 x 1.10

= USD 663.26/Bale

Explanation:

- USD 23,415,285 is the highest sum payable among the 7 years of returning the capital and interest and includes the average capital and interest returnable from the previous 3 years to 10 years. And if it is less than USD 23,415,285, the profit will be even higher.

- USD 3,137,607 is used for monthly payments of capital, interest and daily expenses.

- USD 0.7/sp is the operating cost per day per spindle.

- USD 210.85/Bale is the spindle expenditure for 20’s.

- USD 554.34/Bale is the cost of adding 1.5% transportation tariffs.