Viscose Staple Fiber, Manufacturing Processes, and Properties

Viscose Fibers - fibers made by chemical treatment of natural cellulose

The accessibility of raw materials and the low cost of the chemical reagents, as well as the satisfactory textile properties and broad possibilities for modification, ensure that viscose fibers are economical to produce and widely used.

Viscose Staple Fibre Producers

Source: Fiber Organon

Source : Company Estimates

Zhejiang Fulida CO. LTD

Zhejiang Fulida CO., LTD formerly Zhejiang Fulida Fiber CO., LTD, is a foreign-invested limited liability company since DEC 2009. The company is located at Linjiang industrial zone, Xiaoshan, Hangzhou City. Zhejiang Fulida CO., LTD, a Sino-foreign joint venture specialized in producing viscose staple fiber and differential &functional viscose staple fiber. The company is also mainly involved in the distribution and technical development of viscose staple fiber.

Zhejiang Fulida CO., LTD, the largest viscose staple fiber manufacturer in China, is recognized as a leader in the field of the viscose staple fiber industry. The products are awarded as China’s top brand and Hangzhou’s famous brand. The company is one of the participants in the organization of the viscose staple fiber national standard. Also, the company is a participant in drafting Zhejiang standards of viscose (long, short) unit of energy consumption limitation and calculation method. The company takes a leading position in energy saving, environment protection, production technology, and equipment, with multinomial patents for invention and utility model patents. Output and market share ranks are the first in the viscose staple fiber industry area.

Xinxiang Bailu Chemical Fibre Group Co., Ltd

Xinxiang Bailu Chemical Fibre Group Co., Ltd.(formerly Xinxiang Chemical Fibre Plant)is one of the largest enterprises specializing in textile raw materials, Its total assets reach RMB 4.0 billion. The company occupies an area of more than 3.0 million square meters. Its economic profit ranks the front position among viscose enterprises in China.

The main productions are centrifugal viscose rayon filament yarn, continuous viscose rayon filament yarn, viscose staple fiber, polyester, spandex of 5 series with more than 100 varieties, The company newly developed 10 items of a functional fiber, such as dope clyed yarn bamboo viscose filament yarn, soya bean viscose fiber, and obtain patents more than 30 items, The products sell well in domestic market and foreign market. The trademark is “Bailu”.(“Egret” in English).

The company was established in 1960 and put into production in 1965. Through more than 40 years’ development, its annual production capacity has reached 108,000 tons, including viscose rayon filament yarn 50,000 tons, viscose staple fiber 50,000 tons, synthetic fiber 5,000 tons, spandex 3,000 tons. And the company has the biggest continuous viscose rayon yarn production line and the advanced production line for continuous polymerization, dry spinning spandex. The company has the biggest viscose rayon yarn production capacity in the world.

Grasim Aditya Birla Group

Grasim Industries Limited is a global leader in viscose staple fiber and ranks among India’s largest private sector companies with a consolidated net revenue of Rs.216 billion and consolidated net profit of Rs.22.8 billion “(FY 2011). starting as” a textiles manufacturer in 1948, Grasim’s businesses today comprise viscose staple fiber (VSF), cement, chemicals, and textiles. Its core businesses are VSF and cement, which contribute over 90 percent of its revenues and operating profits at a consolidated level.

Grasim Industries Limited is a global leader in viscose staple fiber and ranks among India’s largest private sector companies with a consolidated net revenue of Rs.216 billion and consolidated net profit of Rs.22.8 billion “(FY 2011). starting as” a textiles manufacturer in 1948, Grasim’s businesses today comprise viscose staple fiber (VSF), cement, chemicals, and textiles. Its core businesses are VSF and cement, which contribute over 90 percent of its revenues and operating profits at a consolidated level.

The Aditya Birla Group is the world’s largest producer of VSF, commanding a 21 percent global share. Grasim, with an aggregate capacity of 333,975 tpa has a global share of 11 percent. It is also the second-largest producer of caustic soda (which is used in the production of VSF) in India. As a result of restructuring in FY 2010 and FY 2011, the cement business has been consolidated with Grasim’s subsidiary, UltraTech Cement Limited. UltraTech has a capacity of 52 million tpa and is a leading cement player in India and the eighth largest in the world.

Grasim has a strong presence in fabrics and synthetic yarns in India through its subsidiary, Grasim Bhiwani Textiles Limited, and is well known for its branded suiting’s, Grasim and Graviera, mainly in the polyester-cellulosic branded menswear. Its textile plants are located at Bhiwani (Haryana) and Malanpur (Madhya Pradesh).

Indian VSF Industry

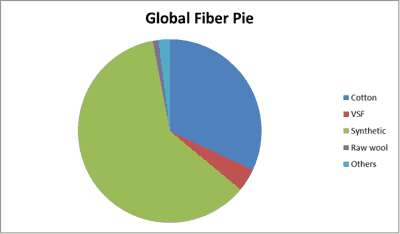

Viscose IS the first man-made fiber to be produced in India. Viscose fiber production is mainly concentrated In Asia which contributes to more than 51% of the world’s production. The major players in Viscose fiber production are China, India, Indonesia, Taiwan, Germany, Austria, etc. India Stands as one of the major Producers of Viscose staple fiber.

There are only two players in India, namely Grasim Industries Ltd and SIV industries Ltd. Grasim Industries commenced production in 1954 and SIV Industries Ltd in 1961, From a modest beginning of about 50,(‘000)Mtons per annum of Man-made Fibre & Filaments in India, it has grown over a period & in ‘94.‘95, it has recorded production of 887(‘000) Mtons which is nearly 17 Times growth. This fiber was initially expected to be a replacement for cotton. However, with the market trends & changing fashion, Pure Viscose spun yarn fabrics are being popular, and “Erode” in South India is the hub of Pure Viscose weaving and processing. Fabrics produced will find usage in printing & dyeing for various end uses.

In ’70s when there was an acute shortage of cotton, the Government of India made it compulsory that at least 10% of Viscose should be blended with cotton. India being a tropical country, with the arrival of Polyester, Viscose friends a blending Partner and Polyester-Viscose which IS unique to India have found innumerable usage in Suiting, Shirtings and Dress materials. With the rapid developments of the Viscose market, in the present Situation, Viscose has been recognized as a fiber by itself and in India Viscose is no longer dependent on the up and downs of the Cotton Market.

VSF Exports of India

Viscose spun yarn and the fabrics made thereof, forms an important Segment in the export earnings of India. Pure Viscose spun yarn exports which were Rs. 200 million in (‘90-‘91) have shown a remarkable increase of 7 times to Rs. 1400 million (40million US $) in (‘95’96). During the same period, Polyester- Viscose Yarn has increased from Rs.293 million to ‘Ps. 2040 million. (58 million US $). The export of fabrics made of Viscose spun yarn and polyester/viscose spun yarn has also been steadily increasing and in the year (‘94.‘95) the export of the above fabrics accounted for Rs.2502.3 million (71.49 million US$). In India, there is a good potential in improving the export of Viscose-based items and with the encouragement from the Government of India, heavy capital investment in spinning, weaving, processing, and garment manufacture, the exports will scale new heights.

Industry Entry Barriers

The VSF industry continues to remain highly concentrated due to the following reasons :

- New players were unable to enter the industry in the 1980s due to government licensing issues. In the 1990s, no new players set up capacities, given the stringent environmental laws and conditions that the new VSF plants had to conform to.

- Any new entrant needs to make arrangements for an adequate and reliable supply of wood pulp. Arrangements would have to be either through captive facilities or long-term import contracts.

India’s Viscose Production Capacity

The past few decades have witnessed predominant use of natura1 cellulose from wood pulp to create a very wide range of Viscose fiber. India accounts for nearly 10% of the World’s VSF Capacity. At present installed capacity in India is 223.9 (‘000) M Tons per annum with M/s.Grasim Industries Ltd has an installed capacity/ of 184.9 (‘000) M Tons per annum worth plants at Nagda, Harihar & Mavoor. MIS. SIV Industries Ltd with an installed capacity of 38.95 (‘000) MTons per annum accounts for 18% of India’s Capacity and the plant is located at Sirumugai in Tamil Nadu, South India. Both the manufacturers have ambitious expansion programs.

The total capacity in India is likely to reach a level of 338.2 (‘000) Mtons per annum by 2000 AD. The demand for Viscose is increasing year after year due to its specific properties like high absorbency & better dye uptake.

Capacity and Production Trends (Million kg)

Source: Crisil Research

VSF Domestic Demand

Demand Analysis and growth rate of past years

Source: Crisil Research and Industry

Trends in Usage

Viscose Staple Fibre produced in India finds an outlet in pure spinning which is converted into fabrics for both dyeing and printing qualities and is characterized by ease of dyeing, good absorbency, rich and full dying properties, and is mainly exported. Viscose, as an excellent fiber for blending, has an outstanding future both in clothing and increasingly In the Nonwoven and hygiene sectors. In blended yarns, viscose staple fiber is popular in Polyester blends. This is mainly because of the hygroscopic property of Viscose and its clean nature. It also has the advantage of staple tut length and ease in spinning on a cotton spinning System.

Hence, viscose will serve as a major complementary fiber. Although the nonwoven Segment imports infancy in India. there will be a demand for absorbent fibers in various fields & nonwovens like personal hygiene, wipes, medical applications, disposables, and filter industry Quality has become an increasingly important distinguishing feature.

Recently, there is a rise in the manufacture of fine denier fibers. The Change In market behavior In the fine denser area exerts a direct influence on process control in viscose manufacture. Parallel to the development in the synthetic fiber area, the shift of market shares in favor of finer deniers in the recent past took place at an extreme Speed. This represents a threat which is explained by the decrease in linear production on one hand and on the other hand, the sensitivity of fine denier fibers towards the production process leading to a drop in quality. This has prompted manufacturers to narrow the process Parameters and maintain effective process control using electronic control devices.

Challenged faced by the Indian Viscose Industry

Viscose Industry is basically highly capital Intensive and this makes it unviable for new entries and hence makes expansion more sensible. The capital cost in India is very high and the rising cost of production makes it difficult to gain a foothold in the international market.

The cost of energy is high due to the low plant load factor and excessive transmission losses. Pulp cost is another major cost component that leaves the manufacturers with no other option but to modify the infrastructure and technology to suit the location for feasibility and attain a competitive edge. The Problem of pollution in the Pulp and Viscose industry needs to be analyzed carefully since the pollution control is highly capital intensive and also results in high running costs.

In India, the problem of pollution is well recognized and the manufacturers are making large investments in this direction. India is carefully watching the latest developments in solvent spinning technology and very soon, manufacturers may opt for this based on the viability.

Alternate Raw-materials for Viscose Manufacturing

Since the beginning of Viscose manufacture, renewable forest wood such as Eucalyptus, Pines Paula, Wattle, and Bamboo has been the major raw material for wood pulp manufacture in India. Nonavailability and high costs have prompted producers to look for alternatives, There is considerable headway in using green jute and Biogases as a substitute for wood. These are agricultural or industrial byproducts and India being the second largest Producer of Jute, there is abundant availability Use of these raw materials also prevents deforestation and hence aids in preserving ecology. Trials in developing hybrid varieties of eucalyptus grown in the plains have also been successful.

Viscose fiber industry technology development direction

With the development of science and technology of modern society and people return to nature and environmental awareness enhancement, viscose fiber with its complete varieties, excellent properties, more and more application industry, and consumers. Its application scope has been expanded from traditional industries to clothing, adornment, health and industrial products, etc. But viscose fiber production with other chemical fiber production, there exist problems of environmental protection. In addition, viscose process of production equipment and also too multifarious, the equipment investment is high. Therefore only in solving these problems, under the premise of viscose fiber industry can more quickly develop healthily.

Viscose fiber industry technology development direction of roughly can be summarized as the following several aspects:

- reduce the pollution of the environment, development of new spinning cellulose fiber manufacturing system.

- production process rationalization and optimization.

- strengthen the basic theories of viscose fiber.

- the development of new technology, expand the pulp pulping sources of the raw materials.

- to improve the existing fibers with a special performance, the development of new varieties.

Viscose Price

The price of Viscose Staple Fibre was on an upward trend since the start of 2010-11, backed by rising wood pulp prices and supplemented by firm cotton prices. Although high prices dented the domestic demand for VSF in 2010-11, manufacturers kept prices firm, drawing support from an unprecedented rise in cotton prices. VSF prices reached an all-time high of ₹ 155 per kg in 2011.

Viscose staple fiber market followed a downward trend and prices went down due to sluggish demand from the downstream market in the Chinese domestic market. The viscose staple fiber market remained weakened due to a sluggish market outlook during the second half. Viscose staple fiber prices moved down triggered by the rumors about low price product availability in the market during the period.

Key Enterprises

| Sr.No. | Name of the Company | City |

| 1 | Grasim Aditya Birla Group | Mumbai, Nagda, Harihar,Kharach |

| 2 | Ugan Impex Limited | Surat |

| 3 | Everyflow Petrofils Limited | Mumbai |

| 4 | Orange Yarns | Surat |

| 5 | Ridhi Fibres | Amritsar |

| 6 | Rameshwar Textiles | Surat |

| 7 | Raj International Limited | Surat |

| 8 | Lenzing Modi Fiber India Pvt Limited | Mumbai |

| 9 | Century textile and Industry Limited | Mumbai |

| 10 | Hanung Toys and Textiles Ltd. | Mumbai |

Conclusion

The rapid increase in demand for fibers in the coming years will require major expansions in the capacities of fiber production. This situation will cal1 for expansion In the man-made fiber sector as natura1 fibers may not be able to address the requirement. Synthetics will certainly grow but will require a good blending component. Viscose will have a strong Position in the future as an alternate raw material because of:

- Growing demand for absorbent fibers

- Renewable raw material sources

- Biodegradability

- Excellent for blending

- Niche fiber in fashion design

- Excellent dyeing and comfort characteristics.

In the future, the market demand for cellulosic fiber and yarn will continue to be buoyant due to the positive physical properties of the fiber. The main reason behind this is the constant increase in Viscose productivity paralleled by the reduction in average denier acting as a guarantee towards Viscose industry’s continued importance in the next century. The quality of the product and the economic production of the same and necessary measures taken regarding environmental protection will a play crucial role in the development of viable solutions for the long term. As an important raw material with unique properties, Viscose has all the necessary strengths to reign in the future in the Indian Textile Industry.

Bibliography

- http://texmin.nic.in/policy/Fibre_Policy_Sub_%20Groups_Report_dir_mg_d_20100608_2.pdf

- http://www.researchandmarkets.com/reports/1543027/world_viscose_trends_in_demand_and_suppy_2010

- http://www.lenzing.com/fileadmin/template/pdf/konzern/lenzinger_berichte/ausgabe_81_2002/LB_2002_Kogler_02_ev.pdf

- http://www.grasim.com/products/birla_viscose.htm

- http://grasim.com/investors/downloads/Grasim_Q3FY12-13_Presentation.pdf

- http://grasim.com/investors/downloads/Corporate_Presentation_jan13.pdf

- fibre2fashion.com/…/viscose-staple-fibre-vsf-price-trends-industry-

- livemint.com/…/Viscose-staple-fibre-plays-spoilsport-for-Grasim-I

- http://www.moneycontrol.com/news-topic/viscose-staple-fibre/

- adityabirla.com/Businesses/Profile/Grasim-Industries-Limited

- yarnsandfibers.com/…/viscosestaplefibre-vsf-price-trends-reports

- http://www.dealcurry.com/BasicIndustries.htm

- tradeindia.com/manufacturers/viscose-staple-fiber.html

- http://articles.economictimes.indiatimes.com/2012-10-11/news/34387516_1_chinese-vsf-vsf-division-viscose-staple-fibre